Confirm Your 1-on-1 Call

Meet with David Stein, Asset Camp’s Chief Investment Strategist and get:

- A crisp market narrative – what happened, where we stand now, and what could lie ahead.

- Data-backed opportunities & risks – which markets look attractive, which don’t, and why.

- Answers to your questions – ask David the stock and bond questions you need answers to.

Powered by Asset Camp’s index-based research tools.

David Stein

Co-Founder and Chief Investment Strategist of Asset Camp

David brings three decades of investment experience to his strategist role in providing insights to financial advisors and investors.

Previously, David was a managing partner, Chief Investment Strategist, and Chief Portfolio Strategist at FEG Investment Advisors, a $15 billion institutional investment advisory firm. At FEG, David was co-head of the firm’s 21-member research team, which conducted research on private equity, real assets, hedge funds, equity, and fixed income. He was responsible for FEG’s top-down research, including macroeconomic analysis, market sentiment, model portfolios, and capital market analysis.

David co-founded FEG’s asset management division, developed its investment philosophy and process, and acted as lead portfolio manager. He helped grow assets under management to $2 billion, including assets on turnkey asset management programs used by RIAs and financial advisors.

In 2014, after leaving FEG, David launched Money for the Rest of Us, an award-winning podcast and investment education platform.

Three years ago, David co-founded Asset Camp to give financial advisors and investors the tools and insights that previously had only been available to large institutional investors.

David is the author of Money for the Rest of Us: 10 Questions to Master Successful Investing, published by McGraw Hill.

In his free time, you can find David out hiking in the Sonoran desert, fly fishing the trout streams of Idaho, traveling the globe with his family, or relaxing with a classic work of fiction or non-fiction.

Trusted by over 1000 Investors

I love it. [Asset Camp] puts easy to understand data at my fingertips that would have required hours of searching and several paid subscriptions.”

— Devin Carroll, CFP® Professional–Carroll Advisory Group

I really like Asset Camp’s tools. I see how valuable Asset Camp can be in terms of gaining refined insight and saving time performing investment-related research.”

— Mike, Individual Investor

In volatile markets, your clients want answers and reassurance about their future.

Clients need numbers put into context, and market narratives are hard to piece together on demand

Searching the web for historical P/E ratios, long-term averages, and expected earnings growth is time-consuming and often turns up nothing

Paid research tools often don’t have the answers you need, are too complicated, or cost over $10k

Asset Camp provides expert-level insights backed by powerful tools, so you can guide clients with confidence.

Quickly Analyze the Market with Monthly Strategy Reports

Piecing together market narratives on demand is tough. Quickly deliver insightful analysis and market context to clients with Asset Camp’s monthly investment strategy reports, live Q&A calls with our in-house Chief Investment Strategist, and shareable client commentaries.

Pinpoint Trends with Research Tools Built on Curated Historical & Current Data

Stop wasting time on web searches. Confidently explain stock and bond performance, what drove it, and current risks and opportunities. All using our precise charts and tables, covering 99% of the market.

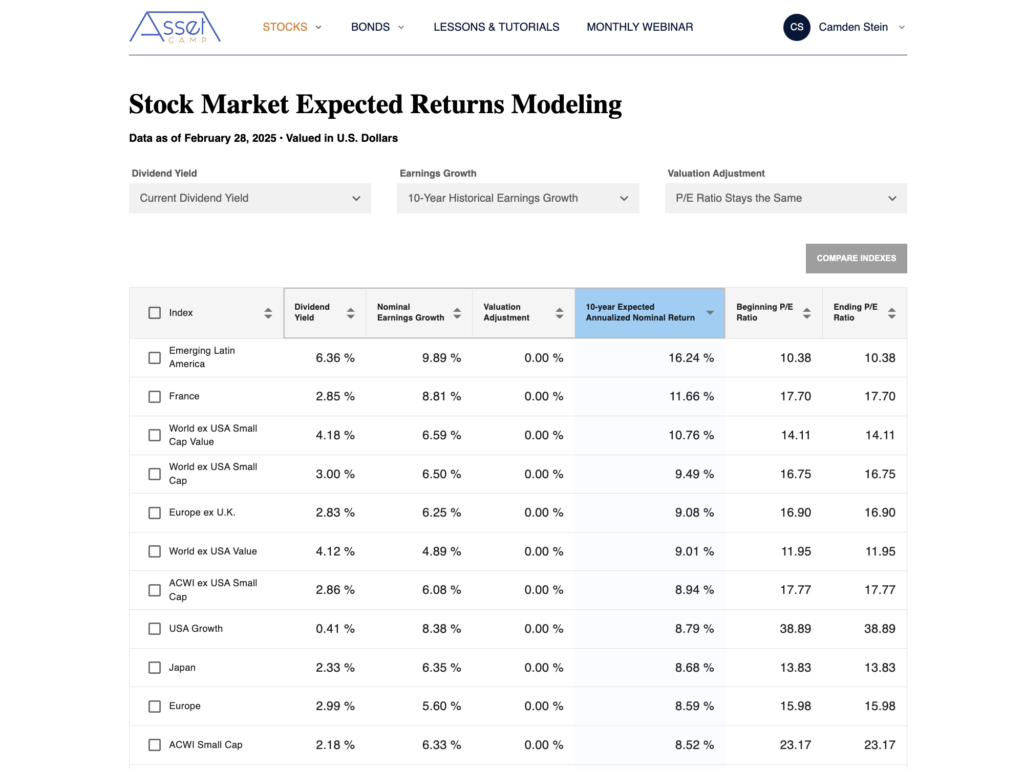

Model Expected Returns for Stock & Bond Indexes

You can’t predict the future, but you can still give your clients clarity. Model potential return scenarios based on changes in valuations, dividends, expected earnings growth, and interest rates.

Trusted by Advisors and Investors Alike

“I love it. This puts easy to understand data at my fingertips that would have required hours of searching and several paid subscriptions.”

Devin Carroll

CFP Professional“Asset Camp is an excellent resource and really delivers on what it is built for.”

Kyle Little

Individual InvestorStuart Page

Individual InvestorPricing

Free Trial: Access all of Asset Camp for 7 days!

Each seat includes:

• Monthly investment strategy reports and live Q&A sessions with our chief investment strategist

• Historical data, averages, and standard deviation bands on 74 stock and bond indexes, covering 99% of the investable market

• Access to over 1,200 charts analyzing equity and fixed income markets.

• Expected return modeling for stock and bond markets

Need More Team Seats?

Add additional seats at $1,000/year.

Contact us to set up a custom plan: team@assetcamp.com

Full Asset Camp Tool List

Stock Index Tools

Historical Tools

Stock Market Returns Summary Table

Stock Market 10-Year Performance Attribution

Stock Market Performance Comparison Tool

Current Trends and Metrics

Stock Valuations and Earnings Summary Tables

Stock Valuations, Earnings, and Trends Charts

Expected Returns Modeling

Stock Market Expected Returns Modeling

Bond Index Tools

Historical Tools

Bond Market Returns Summary Table

Bond Market Performance Comparison Tool

Current Trends and Metrics

Bond Yield, Duration, and Spread Summary Tables

Bond Yield, Duration, and Spread Charts

Yield Curve Spreads Summary Table

Stock Earnings Yield and Bond Yield Spread Comparison

Expected Returns Modeling

Bond Market Expected Returns Modeling

Full List of Stock Indexes, Bond Indexes, and Metrics

Stock Indexes

Global

ACWI All Country World Index

ACWI ex USA Index

ACWI Small Cap Index

ACWI ex USA Small Cap Index

AC Americas Index

AC Asia Index

AC Asia Pacific ex Japan Index

AC Europe Index

Emerging Markets

Emerging Markets Index

Emerging Markets Growth

Emerging Markets Value

Emerging Markets Small Cap

Emerging Markets Asia Index

Emerging Markets Europe and Middle East Index

Emerging Markets Latin America Index

Frontier Markets Index

Developed Markets

World Index

EAFE Index

World ex USA Index

World ex USA Growth Index

World ex USA Value Index

World ex USA Small Cap Index

World ex USA Small Cap Growth Index

World ex USA Small Cap Value Index

Europe Index

Europe ex UK Index

Pacific Index

Pacific ex Japan Index

Countries

Australia Index

Canada Index

China Index

France Index

Germany Index

India Index

Japan Index

Switzerland Index

United Kingdom Index

USA Index

USA Growth

USA Value

USA Mid Cap Index

USA Mid Cap Growth Index

USA Mid Cap Value Index

USA Small Cap Index

USA Small Cap Growth Index

USA Small Cap Value Index

Tracked Stock Metrics

Earnings Yield

Earnings Yield

Forward Earnings Yield

Cyclically Adjusted Earnings Yield

Price-to-Earnings Ratio

Forward Price-to-Earnings Ratio

Cyclically Adjusted Price-to-Earnings Ratio

Price-to-Cash Flow Ratio

Price-to-Book Value

Dividend Yield

Dividend Yield

Payout Ratio

Earnings

1-Year Trailing Earnings Per Share

1-Year Trailing Earnings Per Share Growth

1-Year Forward Earnings Per Share Growth

5-Year Historical Earnings Per Share Growth

5-Year Historical Sales Per Share Growth

Long-Term Forward Earnings Per Share Growth (3 to 5 Years)

Return on Equity

3-Month Moving Average – USD

3-Month Moving Average – Local Currency

10-Month Moving Average – USD

10-Month Moving Average – Local Currency

Bond Indexes

Global

Multiverse (USD)

Global Aggregate (USD)

Global High Yield (USD)

USA

U.S. Universal Index (USD)

U.S. Aggregate Index (USD)

U.S. Corporate Investment Grade (USD)

U.S. Intermediate Credit (USD)

U.S. Corporate High Yield (USD)

U.S. Mortgage Backed Securities (USD)

U.S. Municipal Bonds (USD)

U.S. Treasury (USD)

U.S. TIPS (USD)

U.S. Treasury Long (USD)

U.S. Treasury 1-3 Year (USD)

U.S. Treasury 1-5 Year (USD)

U.S. Treasury 3-5 Year (USD)

U.S. Treasury 5-7 Year (USD)

U.S. Treasury 5 – 10 Year (USD)

U.S. Treasury 7-10 Year (USD)

U.S. Treasury 10-20 Year (USD)

U.S. Treasury 20+ Year (USD)

Developed Markets

Asian Pacific Aggregate (JPY)

Asian Pacific Japanese Yen (JPY)

European Aggregate (EUR)

Pan European Aggregate (EUR)

Sterling Aggregate (GBP)

Emerging Markets

Emerging Markets USD Aggregate

Emerging Markets Local Currency Government (USD)

Tracked Bond Metrics

Size and Quality

Market Value (Trillions)

Number of Issues

Average Credit Quality

Price, Yield, and Spread

Average Coupon

Yield to Maturity

Price

Option Adjusted Spread

Interest Rate Sensitivity

Average Maturity (Years)

Modified Duration

Duration to Worst

Convexity

FAQ

Frequently Asked Questions

How often will I be billed?

Subscriptions renew annually from the date you sign up. After activating your account you can see when your next subscription charge is scheduled in your account menu.

Can I get a refund?

To ensure we can continue to offer competitive rates and maintain the quality of our services, we do not offer refunds.

We provide a 7-day free trial so that you can experience the tools and resources available on Asset Camp and see how they fit into your investment process.

If you feel you have been charged in error at the end of your trial period, please reach out to us and we will work to correct the issue: help@assetcamp.com.

Will more guides and case studies be added to Asset Camp?

Yes! We will continue adding both guides and case studies as needed and as we think of them. If you have a question that you think we should address in a guide or case study, please email us at team@assetcamp.com.

Will Asset Camp get new features?

Yes! Asset Camp is actively evolving. We are always researching and working to build and refine our tools and resources for investors.

Can I suggest new features for Asset Camp?

If you have ideas, feedback, or issues please email us at team@assetcamp.com.

How does the free trial work?

Asset Camp, by default, offers a free 7-day trial of Asset Camp’s full set of tools, reports, commentaries, livestreams, and educational content to all new accounts.

Your free trial lasts 7 days from, and will begin immediately after, you finish confirming the creation of your new Asset Camp account.

Unless you cancel your trial/account, your annual subscription will begin automatically at the conclusion of the trial, and you will be charged the annual subscription price (minus any applied promotional discounts).

Returning accounts are not eligible for free trials and will be charged immediately at checkout.

Will Asset Camp’s price ever increase?

As features are added to Asset Camp the price of membership may increase in line with the value offered.

Prices may also adjust in response to the costs of running Asset Camp, such as our subscription to investment data that we use to build our portfolio tools and reports.

However, we maintain our commitment to providing professional level tools at accessible price levels.

When price increases are set to occur, all accounts are subject at the discretion of Asset Camp.

Subscribers will be notified of any price changes well in advance of them occurring.