Cut Through Market Noise With Powerful Models

The best way to understand these tools is see them in action!

Stock Market Expected Returns Modeling

Model 10-year expected returns for stock markets by adjusting potential dividend yields, earnings growth, and valuation changes. Stress test best- and worst-case scenarios, compare regions by total return or individual drivers, and set clear expectations for clients across a range of market conditions.

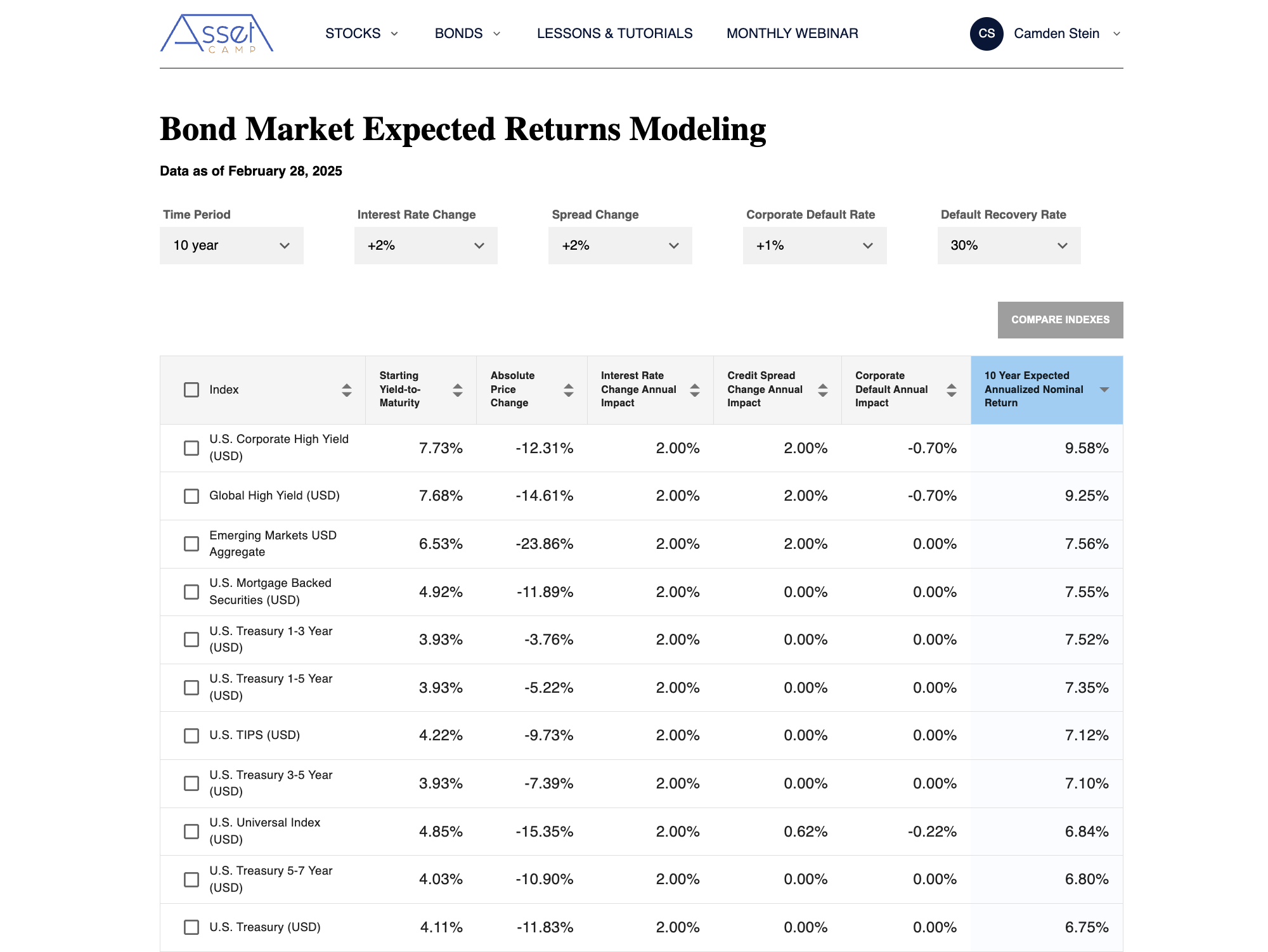

Bond Market Expected Returns Modeling

Model expected returns for 28 bond indexes by adjusting rate changes, spread shifts, defaults, and recovery rates. Stress test best- and worst-case scenarios, pinpoint return drivers, and quickly compare opportunities across bond sectors.