Confidently See How Your Investment Ideas Will Play Out

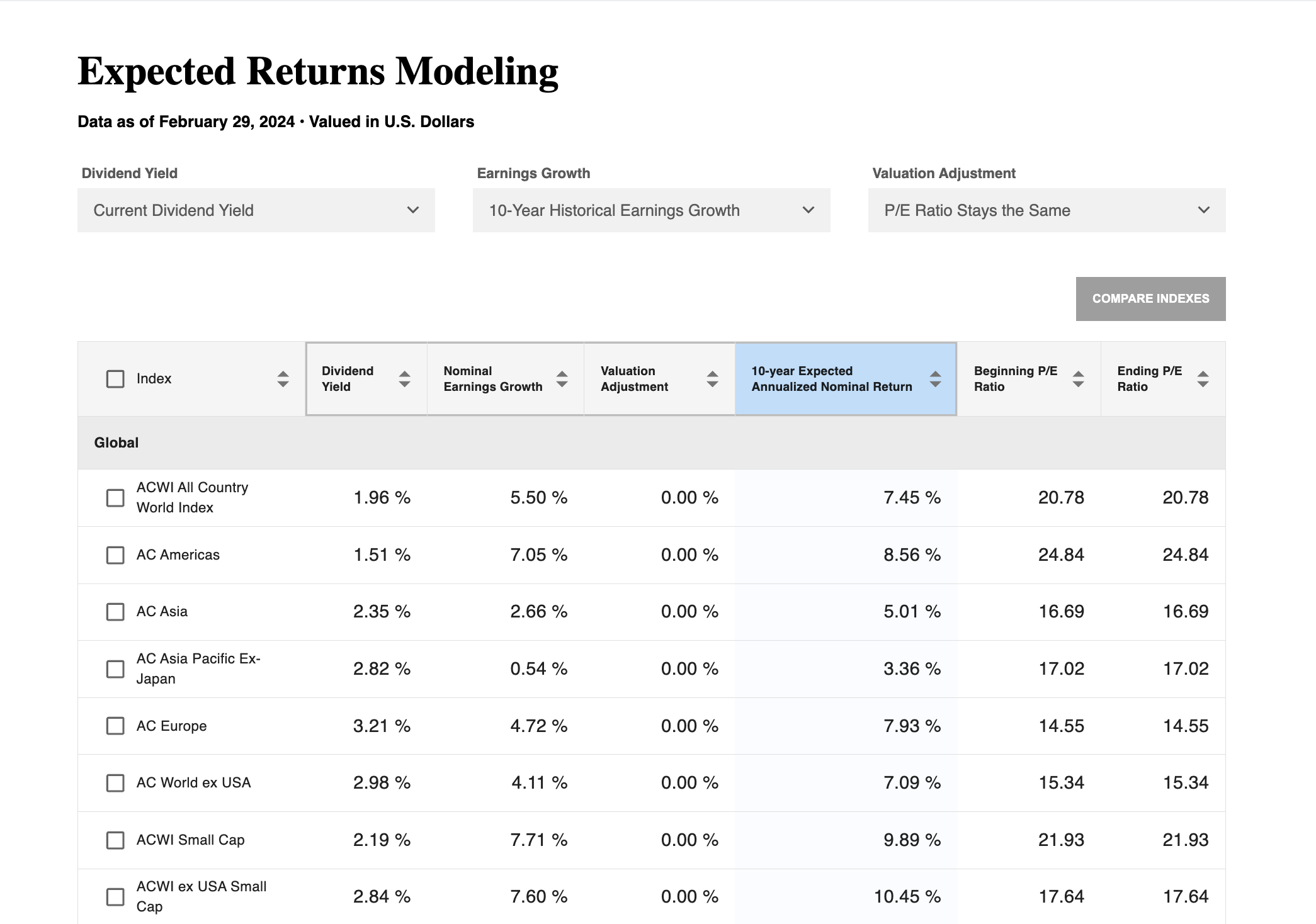

The 10-year expected return is the sum of the dividend yield, earnings growth, and changes in the stock’s valuation. Asset Camp lets you model future performance across all three of these key drivers, giving you a clear picture of the range of future possibilities.

Understand the Range of Potential Returns

Confidently grasp the worst and best case scenarios for different stock market segments.

Make Reasonable, Confident Assumptions

We can’t know the future, but understanding the range of reasonable returns let’s you make confident assumptions about what is coming.

Take Authoritative Action

Understanding real data on the possible outcomes empowers you to authoritatively make the important investment decisions you and others rely on.

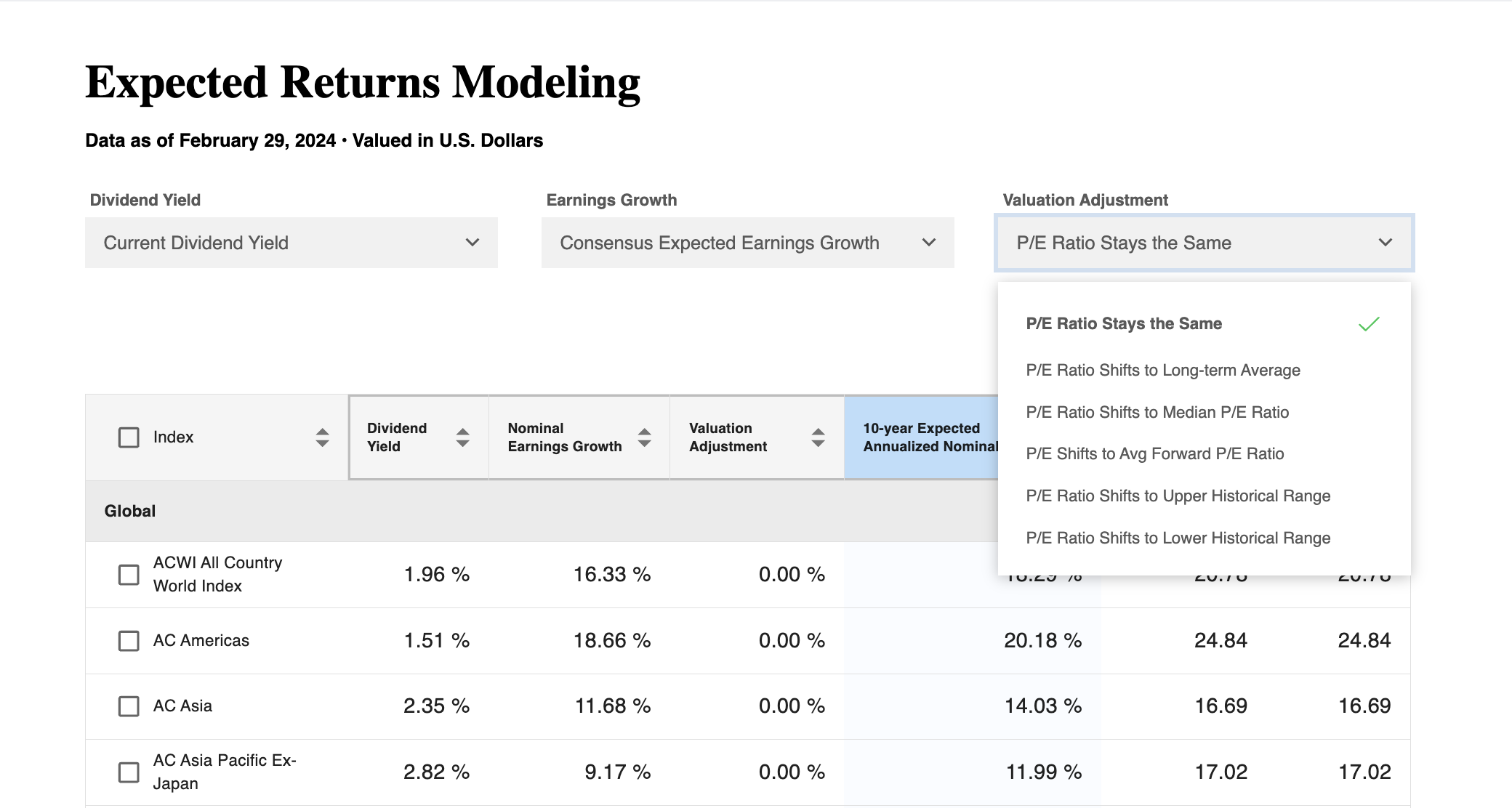

Adjust Key Inputs for Different Performance Scenarios

Adjust each performance driver across different scenarios, such as maintaining current levels, returning to long-term averages, upper and lower historical ranges, and expert consensus expectations. This gives you a clear picture of possible future outcomes.

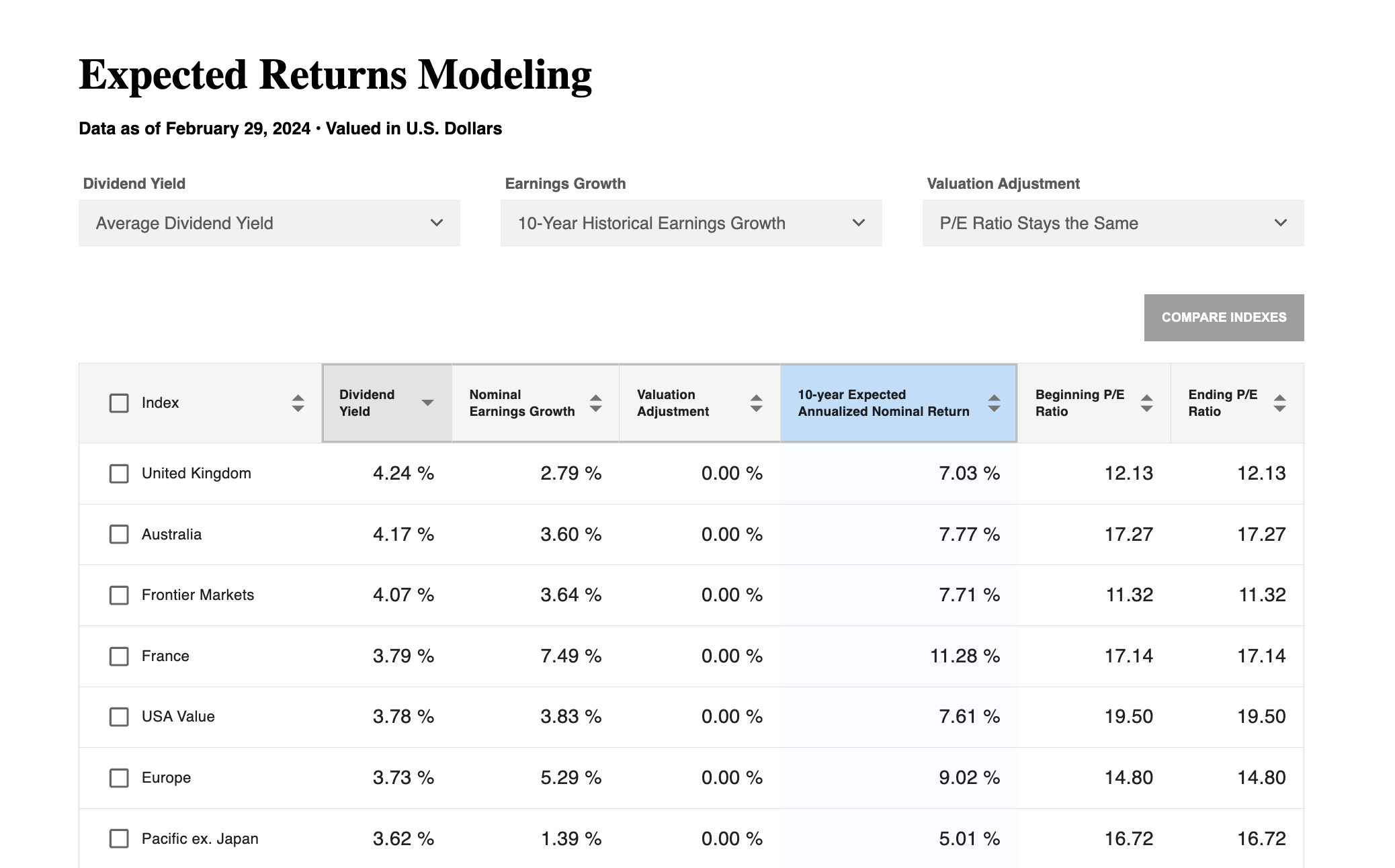

Rank and Sort Indexes by Performance Drivers

See which areas of the stock market have the highest or lowest expected return. Or focus on rankings based on a single driver, such as dividend yield or expected earnings growth.

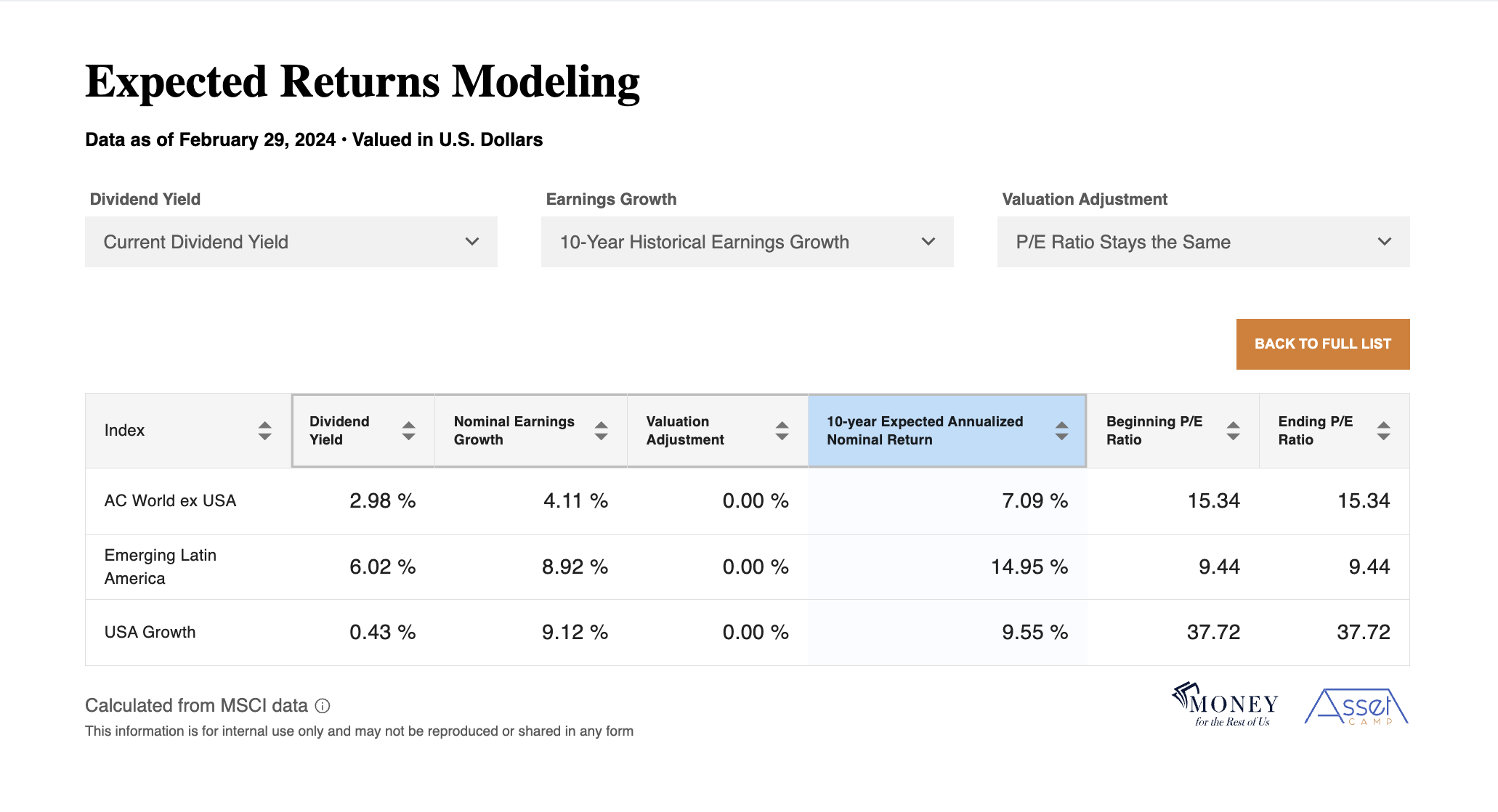

Choose and Compare the Indexes You Care About

Our 46-index list is robust, but you can select and focus on comparing and ranking just the indexes you are interested in.