The 10-year expected returns for a specific stock index is the sum of its dividend yields, earnings growth, and whether stock valuations stay the same, get more expensive, or less expensive.

Using Asset Camp’s Stock Market Expected Returns Modeling Tool, we can model different expected return scenarios by changing the inputs used for dividend yields, earnings growth, and valuations.

Here is more specific information on the three expected return factors and data options available for the Expected Returns Modeling Tool:

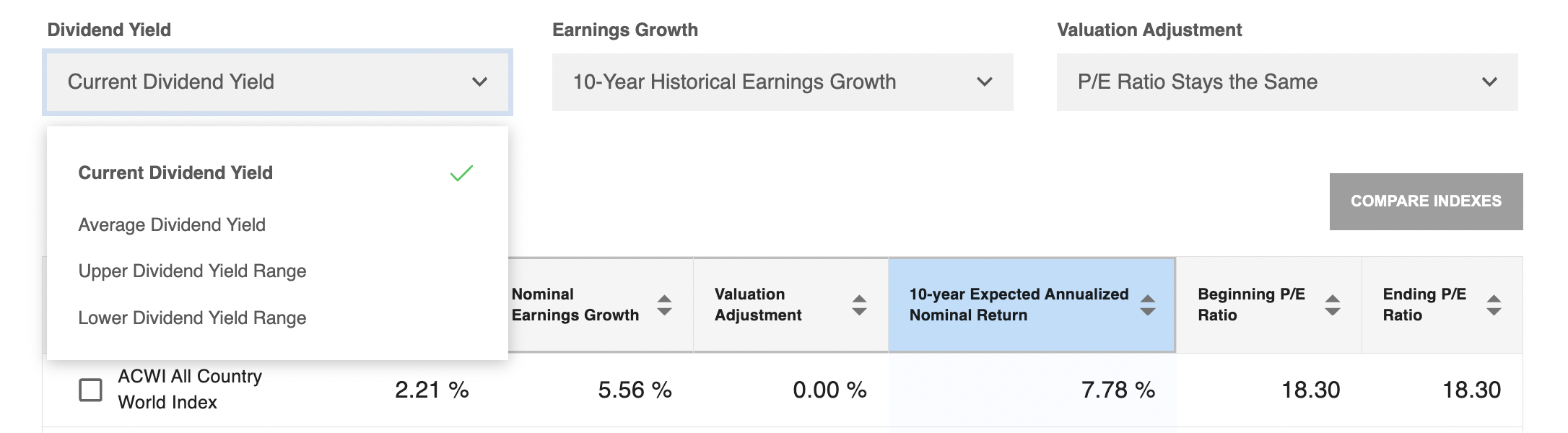

Dividend Yield #

1. Dividend Yield: This cash flow is the portion of corporate profits paid to common stock shareholders as dividends. In Asset Camp’s expected return model, cash flow is expressed as the dividend yield. A stock’s dividend yield is its annual dividend divided by the stock’s ending price.

The dividend yield options for the Expected Return tool are:

- Current Dividend Yield – this represents the most recent dividend yield. This is the default option and usually a good starting point as it assumes dividend yields will stay the same.

- Average Dividend Yield – this represents the index’s average dividend yield since inception

- Upper Dividend Yield Range – this represents one standard deviation above the long-term average dividend yield as reflected in the index’s dividend yield valuation chart.

- Lower Dividend Yield Range – this represents one standard deviation below the long-term average dividend yield as reflected in the index’s dividend yield valuation chart.

Standard deviation is a statistical measure of how dispersed individual data points (e.g. monthly dividend yields) are relative to the average. The wider the range of observations, the greater the standard deviation. We use one standard deviation as the upper and lower bounds for dividend yields because 68% of the historical dividend yield observations fall within that range.

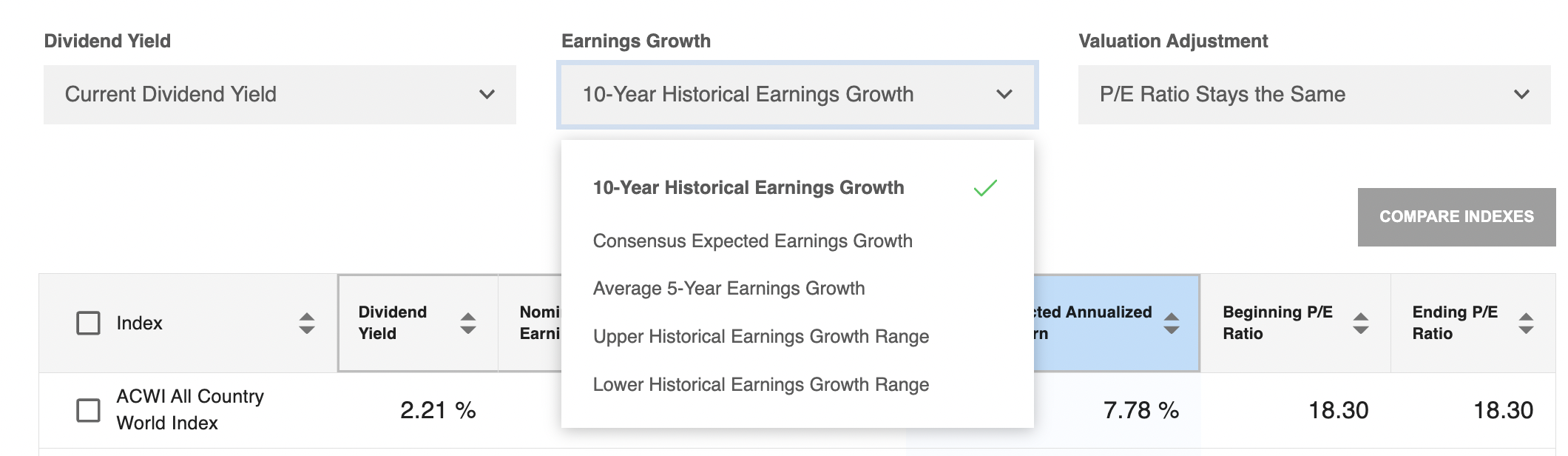

Earnings Growth #

2. Earnings Growth: A stock’s cash dividend can grow if the company’s earnings or profits grow. In Asset Camp’s expected return model, there are a number of historical and forward-looking earnings growth options.

The earnings growth options for the Expected Return tool are:

- 10-Year Historical Earnings Growth – this represents the annualized nominal earnings growth for the past decade. Nominal means before backing out inflation. The 10-year historical earnings growth removes any impact from currency fluctuations. This is the default option and a good starting point as it assumes the earnings growth will be the same as it was in the last decade.

- Consensus Expected Earnings Growth – this represents the aggregate expected long-term earnings per share growth rate based on bottom-up company-specific forecasts by professional financial analysts who follow each company. Please keep in mind analysts tend to be overly optimistic about earnings growth prospects with actual long-term earnings coming in lower than expectations. This is a more aggressive earnings growth assumption.

- Average 5-year Earnings Growth – this represents the average 5-year aggregate earnings per share growth over time for the underlying index holdings.

The average 5-year earnings growth includes the impact of currency fluctuations between local currencies and the U.S. dollar. A strengthening dollar will lead to a lower earnings per share growth rate for non-U.S. indexes while a weakening dollar will lead to higher earnings per share growth rate.

By using the average 5-year earnings growth, half-decade periods where the dollar strengthens relative to the local currency can be offset by periods where the dollar weakens relative to the local currency.

This is a more conservative earnings growth assumption since it incorporates multiple 5-year periods to come to an average and includes currency impact.

- Upper Historical Earnings Growth Range – this represents one standard deviation above the average 5-year earnings growth rate as reflected in the 5-year Historical Earnings Per Share Growth chart in the Stock Market Valuatons and Earnings Reports.

- Lower Historical Earnings Growth Range – this represents one standard deviation below the average 5-year earnings growth rate as reflected in the 5-year Historical Earnings Per Share Growth chart in the Stock Market Valuatons and Earnings Reports.

As mentioned earlier, standard deviation is a statistical measure of how dispersed the individual data points are relative to the average. The wider the range of observations, the greater the standard deviation.We use one standard deviation as the upper and lower bounds of the earnings growth range because 68% of the 5-year earnings growth observations fall within that range.

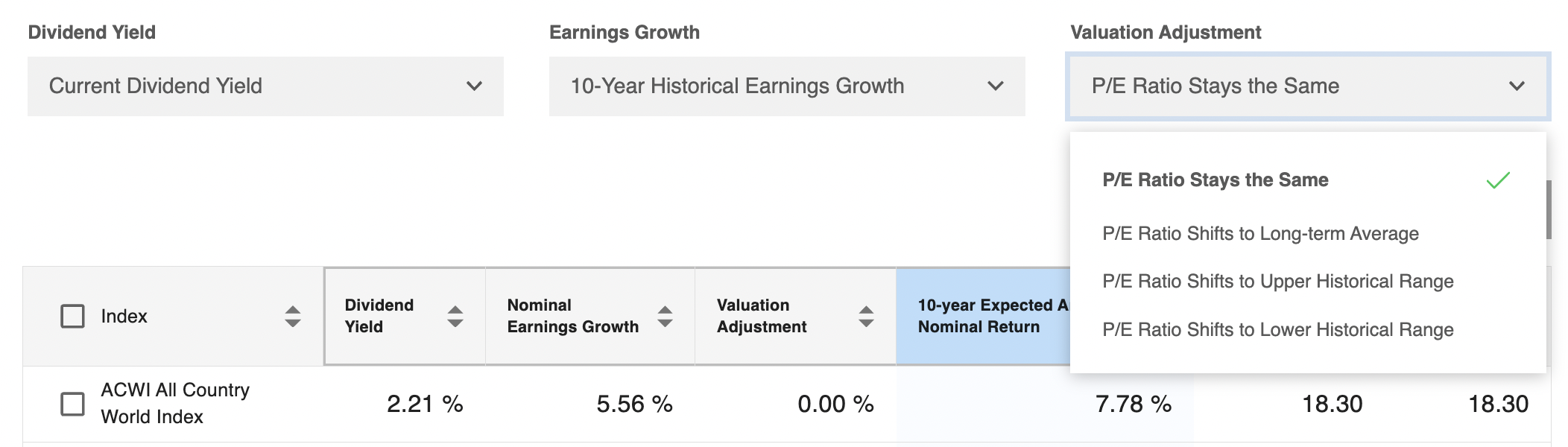

Valuation Adjustment #

3. Valuation adjustment: How much investors pay for stocks today versus ten years from now will impact stock index returns.

Asset Camp’s Stock Market Expected Returns Modeling Tool uses changes in the price-to-earnings ratio to capture the valuation adjustment’s impact on future stock returns.

The P/E ratio measures what investors are willing to pay for one dollar of earnings.

The starting point for each valuation adjustment is the Beginning P/E Ratio, which represents the most recent trailing 12-month price-to-earnings ratio.

The earnings growth options for the Expected Return tool are:

- P/E Ratio Stays the Same – In this scenario, there is no valuation impact because what investors are willing to pay for stocks as reflected by the P/E ratio doesn’t change. The valuation adjustment for all indexes is 0.0% as the beginning P/E ratio equals the ending P/E ratio.

This is the default option as it assumes no valuation adjustments.

- P/E Ratio Shifts to Long-term Average – In this scenario, the valuation adjustment reflects the stock index valuation moving to its long-term average as reflected in the Price-to-Earnings Ratio chart found under the Stock Mark Valuations and Earnings Reports.

The valuation adjustment will be a positive number if the beginning P/E ratio is lower than the long-term average P/E ratio.

The valuation adjustment will be a negative number if the beginning P/E ratio is higher than the long-term average P/E ratio.

This option allows you to see the positive or negative impact of stocks returning to their long-term average valuations.

- P/E Ratio Shifts to Upper Historical Range – In this scenario, the valuation adjustment reflects the stock index valuation moving to its upper historical range of one standard deviation above the long-term average P/E ratio.

The valuation adjustment will be a positive number if the beginning P/E ratio is lower than the upper historical range P/E ratio.

The valuation adjustment will be a negative number if the beginning P/E ratio is higher than the upper historical range P/E ratio.

- P/E Ratio Shifts to Lower Historical Range – In this scenario, the valuation adjustment reflects the stock index valuation moving to its lower historical range of one standard deviation below the long-term average P/E ratio.

The valuation adjustment will be a positive number if the beginning P/E ratio is lower than the lower historical range P/E ratio.

The valuation adjustment will be a negative number if the beginning P/E ratio is higher than the lower historical range P/E ratio.

We use one standard deviation as the upper and lower bounds of P/E ratio range because 68% of the P/E ratio observations fall within that range.