Suppose you want to allocate additional assets to stocks and would like to know which areas of the stock market have the highest expected return.

Starting with the default view that uses the current dividend yield, 10-year historical earnings growth, and no change in valuations, you can rank the stock indexes by highest return to lowest return by twice clicking the arrow next to the 10-year Expected Nominal Annualized Return header.

You can then select the top four indexes and any other index you might want to compare, such as your home country, in order to perform some sensitivity analysis.

To compare a subset of indexes, select the box next to the index name and click the Compare button.

With a smaller subset of indexes, you can now see what the primary driver of the higher expected returns are.

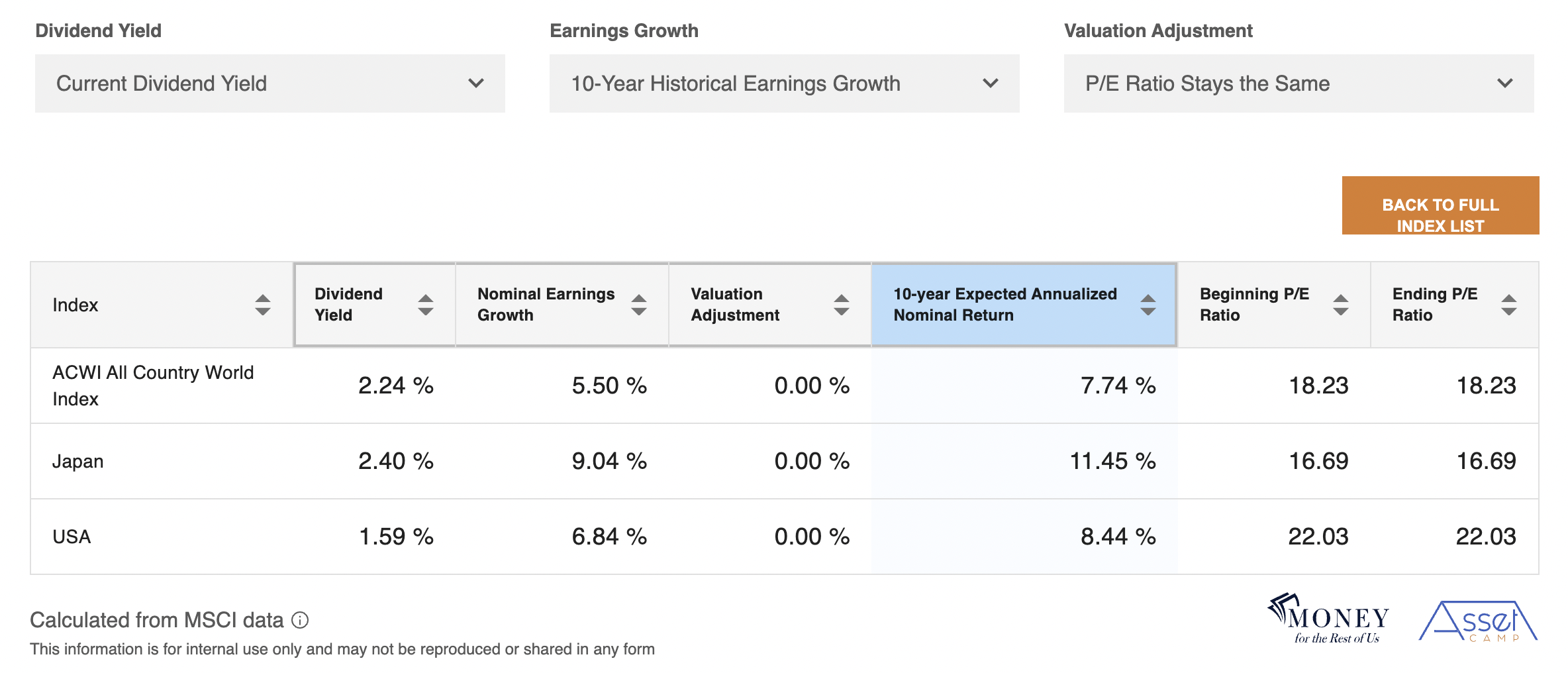

Scenario One #

For example, below we compare Japan, the U.S., and the global stock market as represented by the MSCI All Country World Index.

Japan has the highest expected return when we use the current dividend yield, the earnings growth for the past ten years, and assuming that the price-to-earnings ratios stay the same.

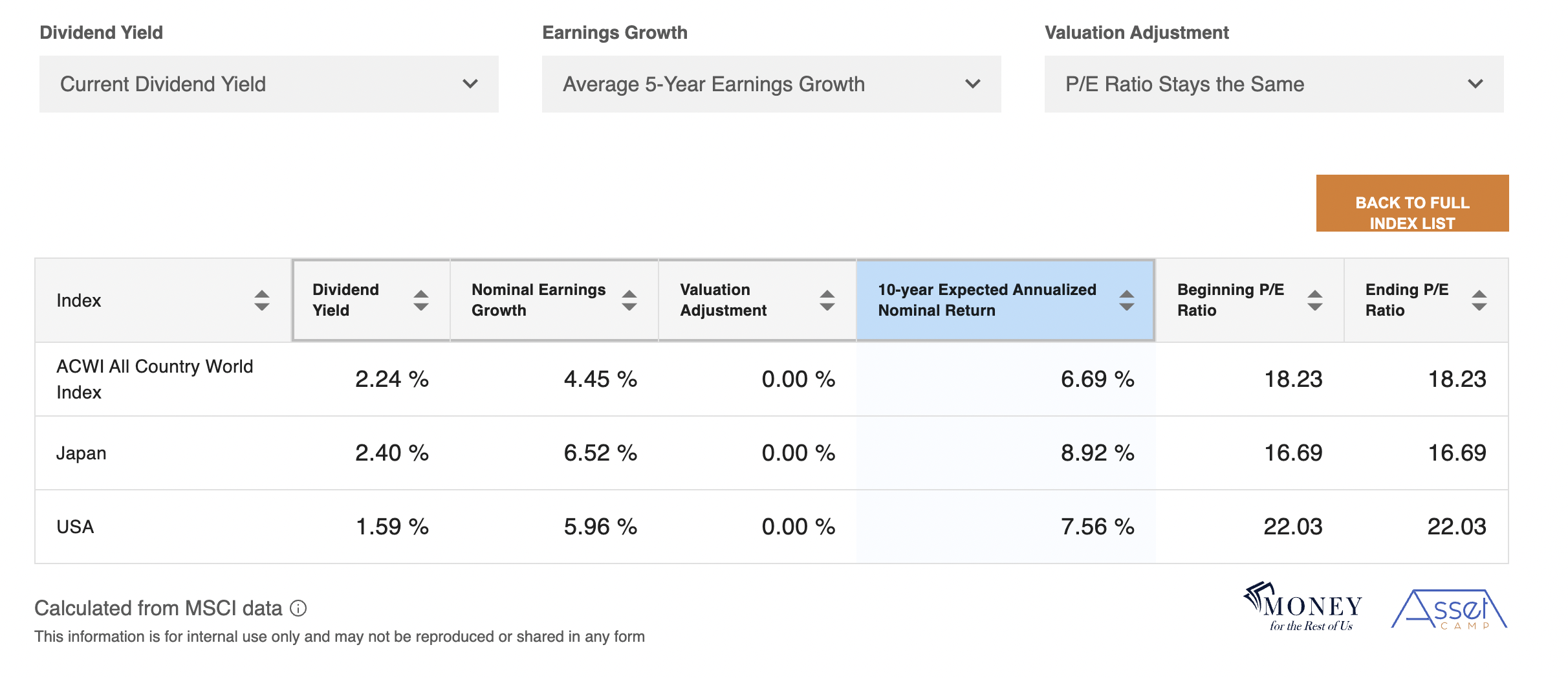

Scenario Two #

In this scenario, we use the current dividend yields, assume P/E ratios stay the, but instead of using the earnings growth for the previous decade, we use the average five-years earnings growth. In other words, we take the average of all the rolling five-year periods available.

Japan again has the highest expected 10-year expected return, but not by as much as in the first scenario.

Additional Scenarios #

We could model out additional scenarios by assuming that P/E ratios returned to their long-term average, or by using the average dividend yield instead of the current dividend yield.

The point of the modeling exercise is not to come up with one right answer.

Rather, by adjusting the assumptions, we can get a sense of the range of reasonable returns for different stock indexes.

Once you have identified an index that you might be interested in investing in, you can reference the sample list of index funds and ETFs that seek to track the performance of that index.