Asset Camp’s Stock Earnings Yield and Bond Yield Spread Comparison Tool allows you to compare the valuations of stocks relative to bonds.

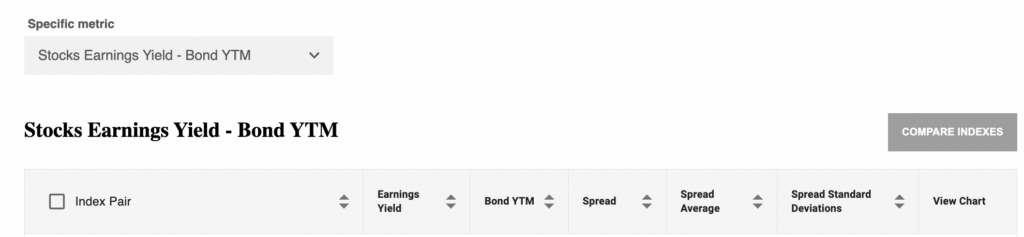

Here is a description of the columns in the table.

The first column on the left is the stock and bond indexes being compared.

Next is the most recent earnings yield for the stock indexes. The stock earnings yield is calculated by taking the index’s earnings and dividing it by its price level.

Stock earnings yield is the inverse of the price-to-earnings ratio. With the stock earnings yield, the lower the yield, the more expensive the valuation.

In the drop-down menu, you can select the earnings yield based on earnings over the previous twelve months. Or you can select the earnings yield based on analysts’ bottom-up estimates of company earnings over the next year.

The next column is the most recent yield-to-maturity (YTM) for the bond index. The YTM reflects prevailing interest rates for bonds. The YTM is an estimate of a bond index’s expected return before accounting for interest rate changes or defaults.

The spread column reflects the difference between the stock earnings yield and the bond yield-to-maturity. It is calculated by subtracting the YTM from the earnings yield.

Next to the spread column is the long-term average spread.

When the spread between earnings yield and YTM is positive, the earnings yield for stocks is higher than the YTM for bonds.

When the spread between earnings yield and YTM is negative, the YTM for bonds is higher than the earnings yield for stocks.

Some regions, such as Europe Ex-UK, have historically had the trailing twelve-month stock earnings yield higher than the bond YTM, while other regions, such as emerging markets, have historically seen bond YTM higher than the stock earnings yield.

That is why it is important to compare the current spread to the long-term average.

The standard deviation column displays how far the current spread is from the long-term average, expressed in standard deviations. The standard deviation is positive if the spread is above average.

The standard deviation is negative if the spread is below average. Larger deviations (up or down) indicate rarer extremes.

The view chart column allows us to view the spread over time relative to its long-term average.

When the spread is narrower than average, that can be due to stock valuations being more expensive than average, as reflected in earnings yield. Or the narrower spread could be caused by the bond YTM being greater than average.

Consequently, we can get greater context on the spread between the stock earnings yield and bond YTM by reviewing the earnings yield charts in the stock tools and the bond YTM charts in the bond tools.

The stock earnings yield bond YTM comparison table and charts are helpful in quickly seeing which regions are experiencing an above or below-average spread, especially as we compare and rank by standard deviations.

We can also quickly determine which regions have historically had higher yields for stocks relative to bonds and vice versa.