Some investors prefer to invest in regions of the stock market with high dividends since dividends are an important driver of long-term stock market performance.

Asset Camp’s Stock Market Expected Returns Modeling Tool can help you decide which region is most likely to maintain a high dividend.

First, rank the indexes from highest to lowest dividend by selecting Current Dividend Yield from the dropdown menu in the top left of the table.

Then click the arrows next to the Dividend Yield heading so that the indexes are sorted from highest dividend to lowest dividend.

Click the box next to the index name for the top eight indexes with the highest dividend yield. Then click the Compare Indexes button.

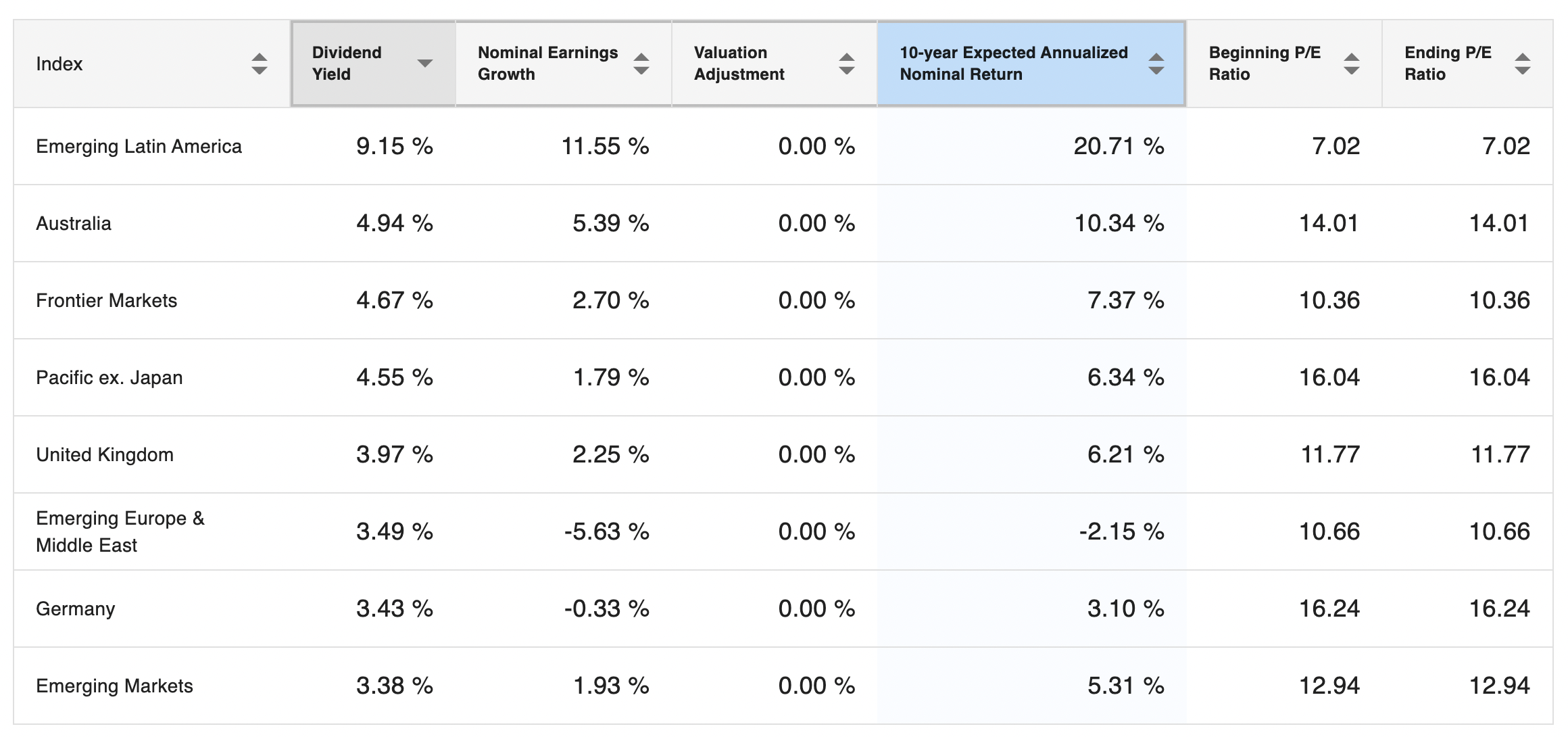

Scenario One #

We now have a subset of indexes we can compare, as shown in this image. The current ranking is based on the indexes’ most recent dividend yield.

The earnings growth assumption is based on the most recent 10-year period.

Emerging Markets Latin America has the highest current dividend yield in this example.

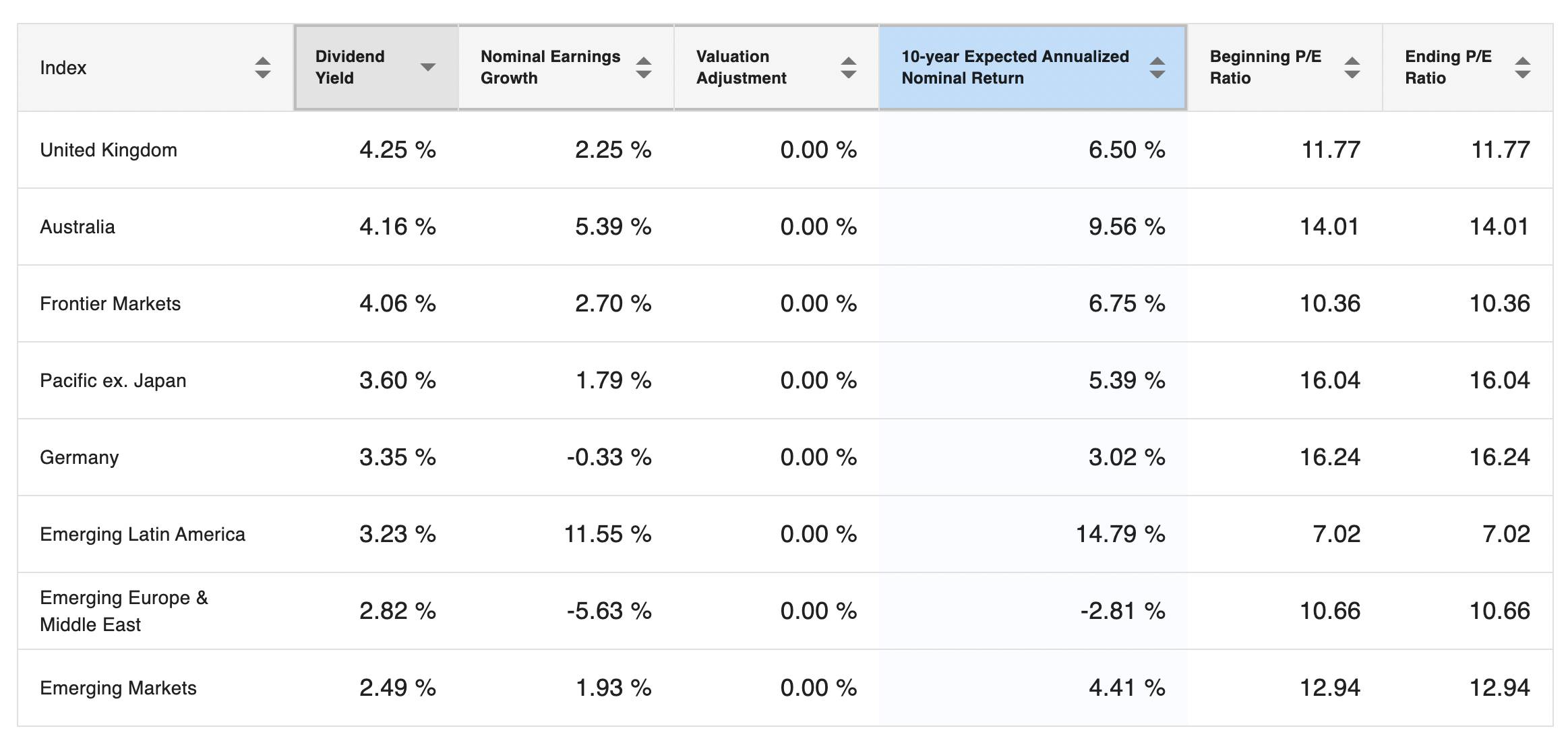

Scenario Two #

Next, we can compare this subset of indexes using other dividend yield metrics, such as the average historical dividend yield.

We do that by selecting a different option from the Dividend Yield dropdown menu.

We can then rank the indexes by highest to lowest dividend yield by clicking the arrows next to the dividend yield heading.

In this scenario, the United Kingdom has the highest dividend yield.

We can further refine our analysis by adjusting the earnings growth and valuation assumptions in order to select a country or region with an attractive dividend yield, low valuations, and reasonable expected earnings growth.

We can use Asset Camp’s Valuation, Earnings, and Trend Charts to get greater detail on an index’s historical dividend yield, earnings growth, and valuations.