Investors might have additional cash they want to invest in a riskier opportunity.

An investor could allocate assets to an area of the market that has done poorly over the past decade in hopes that the asset or region could rebound.

For example, the worst performing area of the stock market over the past ten years might have been Latin America Emerging Markets.

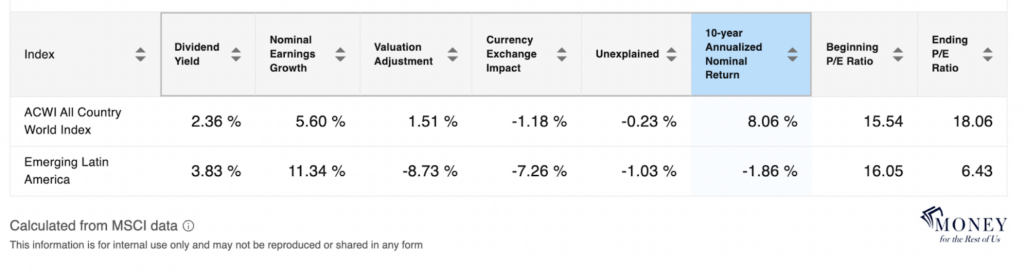

Here is a sample performance attribution of Emerging Markets Latin America compared to global stocks. In this sample, Latin America stocks had a negative return even though their dividend yields were over 3% and earnings grew at over 11% per year.

The negative returns were because the P/E ratio fell from 16.1 to 6.4. Latin America currencies also weakened relative to other currencies.

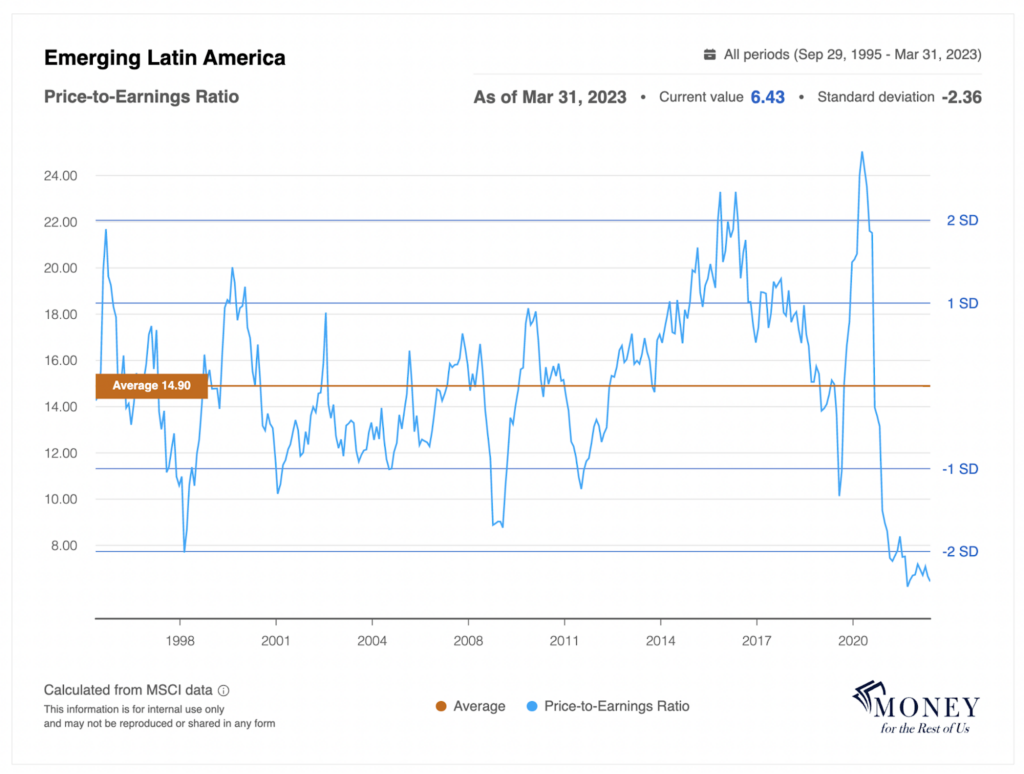

In this sample chart, Latin America’s P/E ratio at 6.4 is near its all time low, more than two standard deviations from its long-term average price-to-earnings ratio of 14.90.

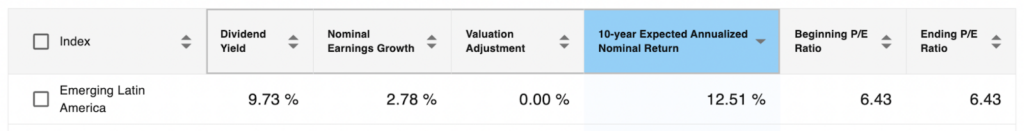

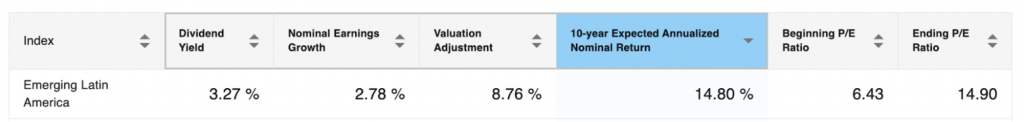

What is a reasonable expected return for Latin America Emerging Market Stocks over the next decade, based on our sample starting conditions?

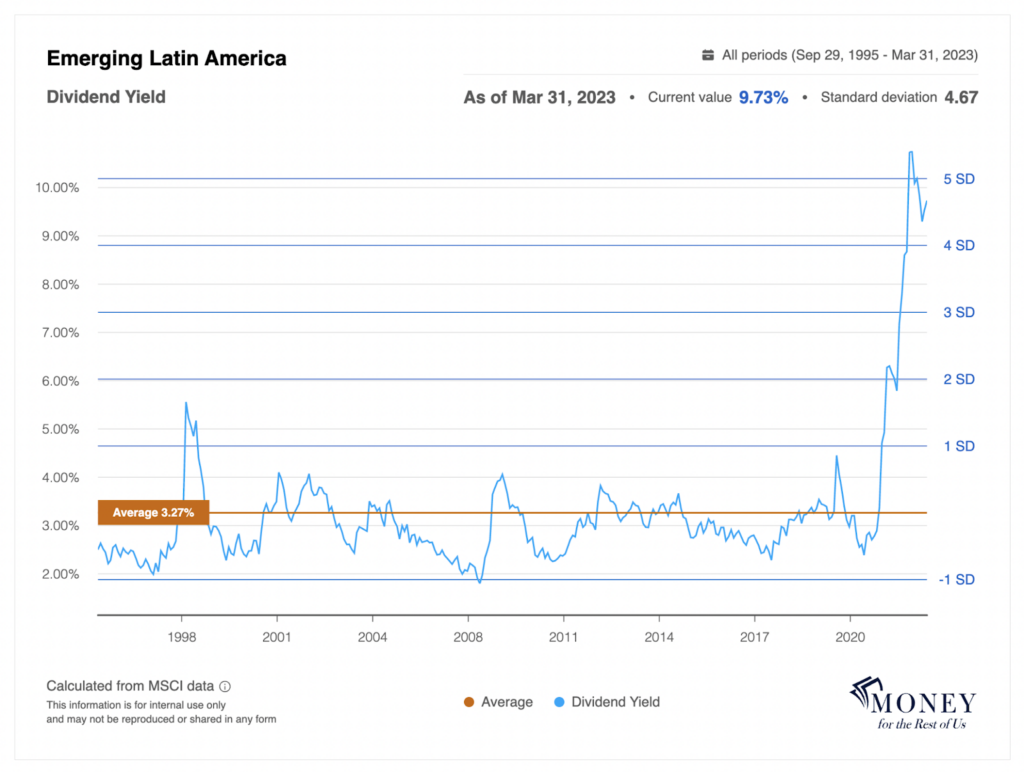

If we assume the dividend yield and P/E ratio stays the same, and that earnings grow at their long-term average rate of close to 3%, the 10-year expected annualized return is over 12%.

Conversely, if we assume that the dividend yield and the P/E ratio shift to their long-term average over the next decade, the 10-year expected return for Latin America Emerging Market stocks is over 14% annualized.

Latin America expected earnings growth is the real wild card. It grew over 11% per year over the past decade in our example.

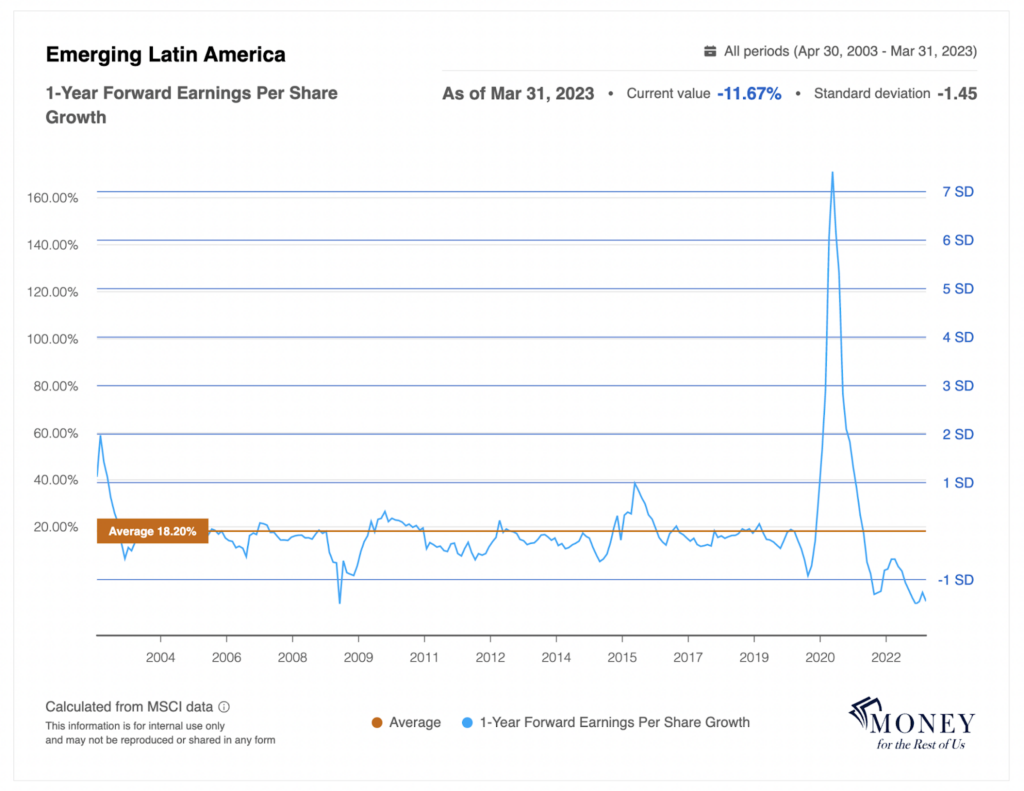

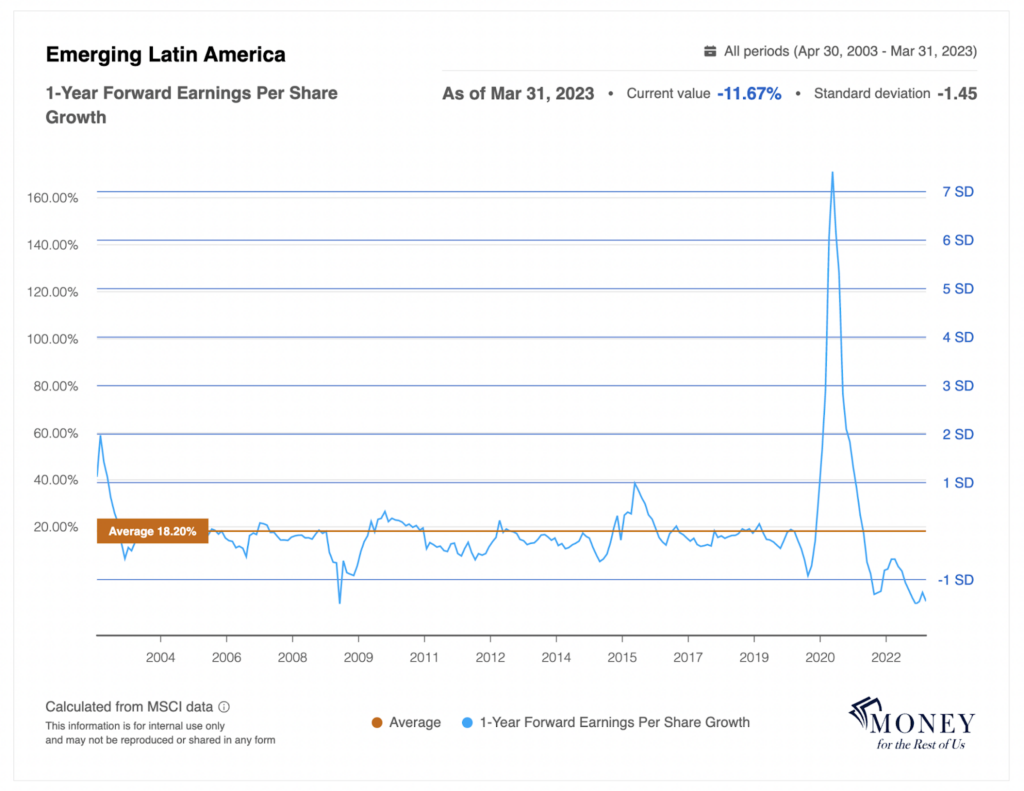

We can use the Asset Camp Earnings and Valuations report to get greater perspective.

This sample chart shows Latin America Emerging Market earnings are expected to fall by almost 11.7% over the next year.

The 11.7% earnings decline is one standard deviation below the long-term average for one-year expected earnings growth.

Notice on the chart during 2020 when one-year earnings growth expectations were over 160%. That extremely high expectations was extremely rare—more than seven standard deviations from the average.

The reason for the large earnings increase was the earnings collapse that occurred during the early days of the pandemic.

Per this next chart, analysts still expect earnings to grow close to 11% over the next three to five years. That earnings expectations is still double digits even though it is one standard deviation below the long-term average earnings expectations of 13%.

The data in our sample case study suggest it is possible that Latin America Emerging Markets stocks could return double digits annualized over the next decade.

This is still a risky investment, however. Latin America countries have both political and economic challenges. The Latin America stock index funds and ETFs are also concentrated, with Brazil making up over 60% of the allocation and the Brazilian Company Vale S.A. comprising close to 10%, depending on the fund.

Once you decide on a region where you might want to invest, you can find sample index funds and ETFs that correspond to the different stock indices on this page.