Stock indexes go through periods of outperformance and underperformance relative to each other.

Sometimes an investor might be frustrated that a specific region, such as non-U.S. stocks, hasn’t performed as well as U.S. stocks.

Knowing why a specific index is underperforming can help us be more patient. We might even decide to allocate more to an index mutual fund or ETF that tracks the underperforming index.

For example, here is a comparison of U.S. stock market returns versus Japan.

You can select indexes to compare as we did in this table by checking the box next to the index name and then clicking the button that says Compare.

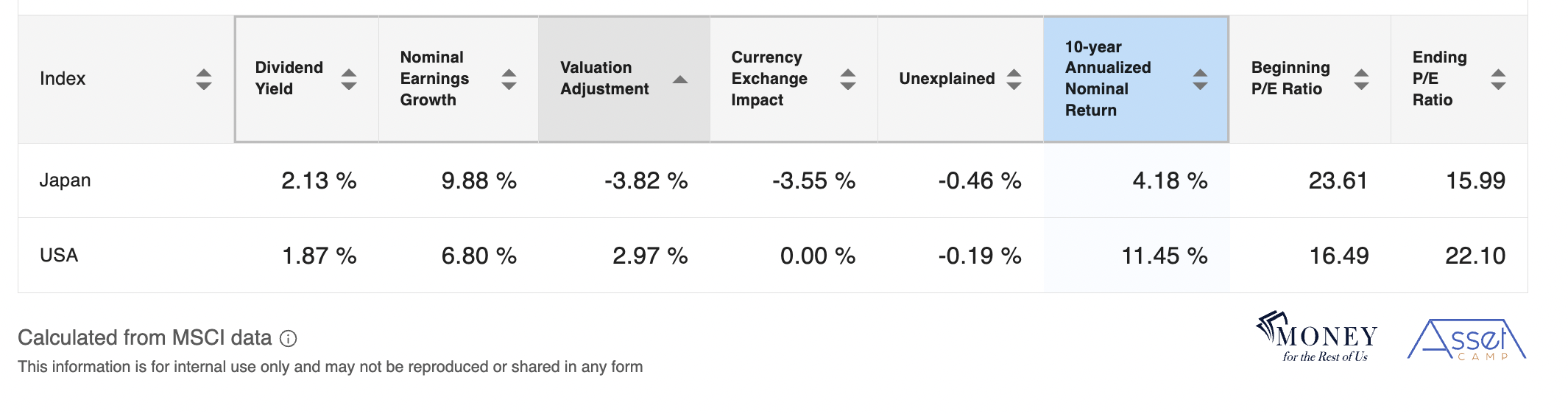

Over the decade shown in the table, the U.S. outperformed Japan by over 7% point annualized.

Yet, Japan had a higher average dividend yield and earnings growth over that decade. Dividends and earnings growth are the primary driver of stock market returns over multidecade periods.

Japan’s underperformance was because its stock market got cheaper, as reflected in the falling price-to-earnings ratio, while the U.S. stock market got more expensive.

You can see the impact in the Valuations Adjustment column. The P/E ratio changes can be seen in the far right columns.

Another reason Japan underperformed in this example is the Japanese yen weakened relative to the U.S. dollar. That -3.6% annual currency impact can be found in the Currency Exchange Impact column.

In this example, an investor might decide to continue to maintain an allocation to Japanese stocks even though they underperformed because it has a solid dividend yield and earnings growth, as well as a lower price-to-earnings ratio. There is also the potential for the Japanese yen to strengthen, further increasing returns.

Asset Camp’s Stock Market Expected Returns Modeling Tool tool can help determine reasonable return expectations for Japanese and U.S. stocks.