Asset Camp’s Stock Market Expected Returns Modeling Tool helps you understand the range of potential returns for the stock market over the next decade.

Understanding the components that will drive future returns can allow you to have reasonable assumptions for the stock market as you save for and invest during retirement.

The Expected Returns Modeling Tool is based on the same factors used to deconstruct the historical returns in the Stock Market 10-Year Performance Attribution Tool.

For each factor, you have a choice of which data set to use. This allows you to model out different scenarios by changing the table’s underlying assumptions.

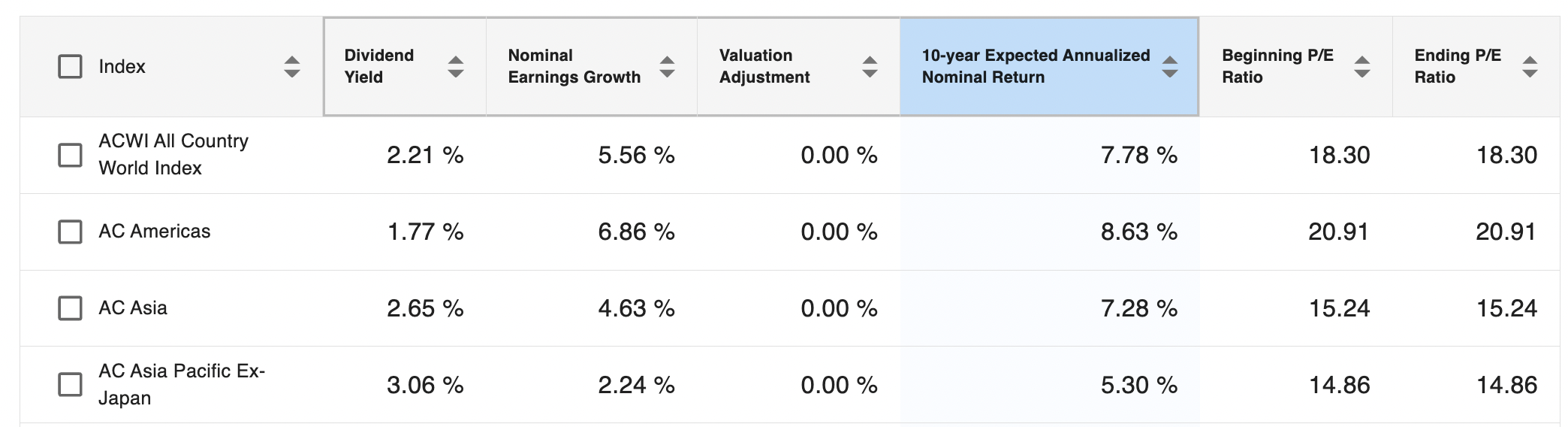

Expected Stock Market Returns

The 10-year expected stock market return for each index is found in the blue column labeled 10-year annualized nominal return. The expected return is the sum of figures in the dividend yield, earnings growth, and valuation change.

The expected returns are annualized in that they show the rate of return on an annual basis rather than showing the total or cumulative return for the entire decade.

The 10-year expected returns are also nominal, which means the returns are before taking into account inflation. An inflation-adjusted return is known as a real return.

We don’t show expected real returns because of the difficulty in forecasting inflation rates for the more than forty countries that make up the global stock market.

Asset Camp’s Stock Market Expected Returns Modeling Tool does not include an explicit currency impact variable. Currency fluctuations are extremely challenging to forecast accurately.

The expected return model assumes the currency exchange rate in 10 years will be the same as it is today.