Knowing What Happened: The Key to Understanding the Stock Market

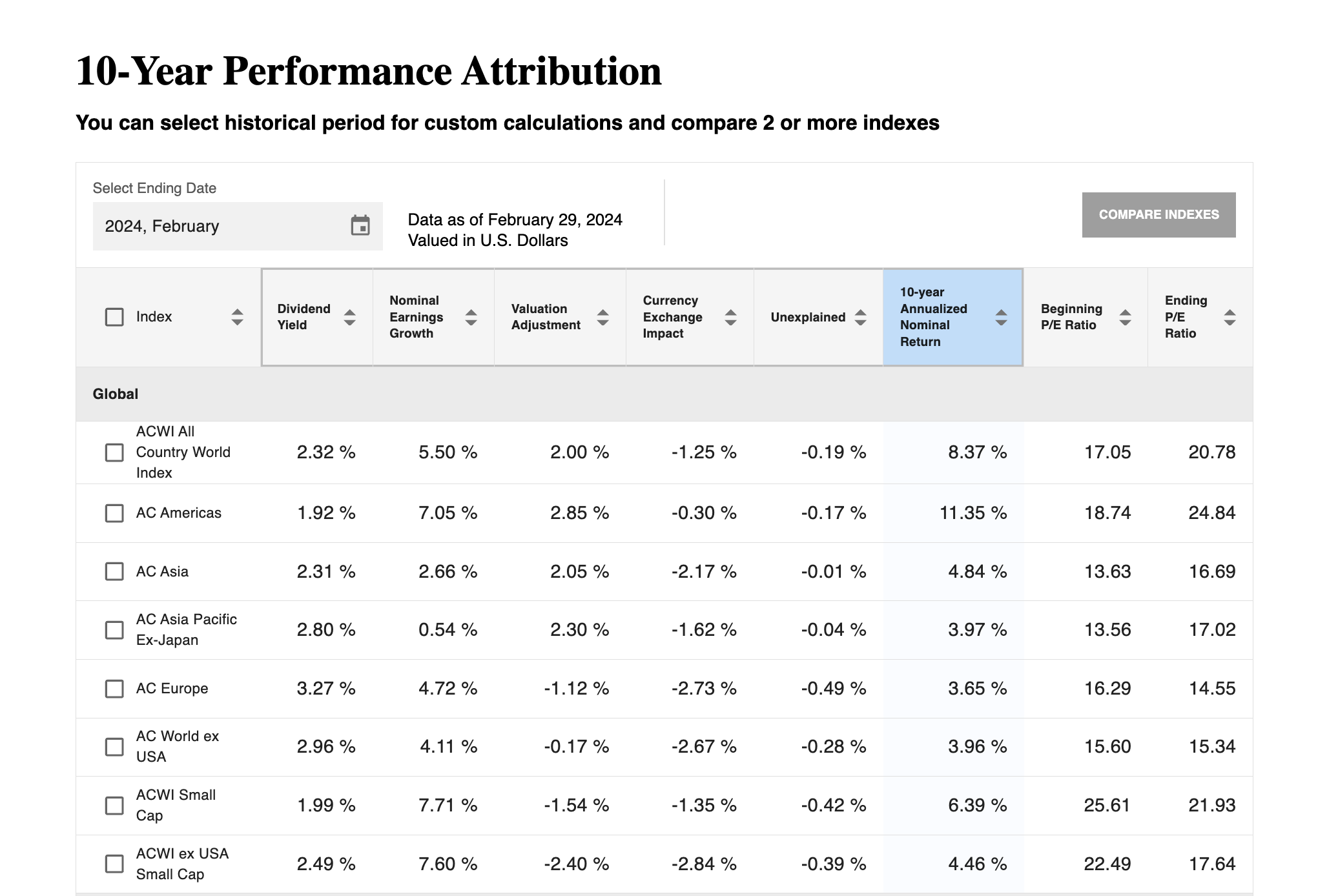

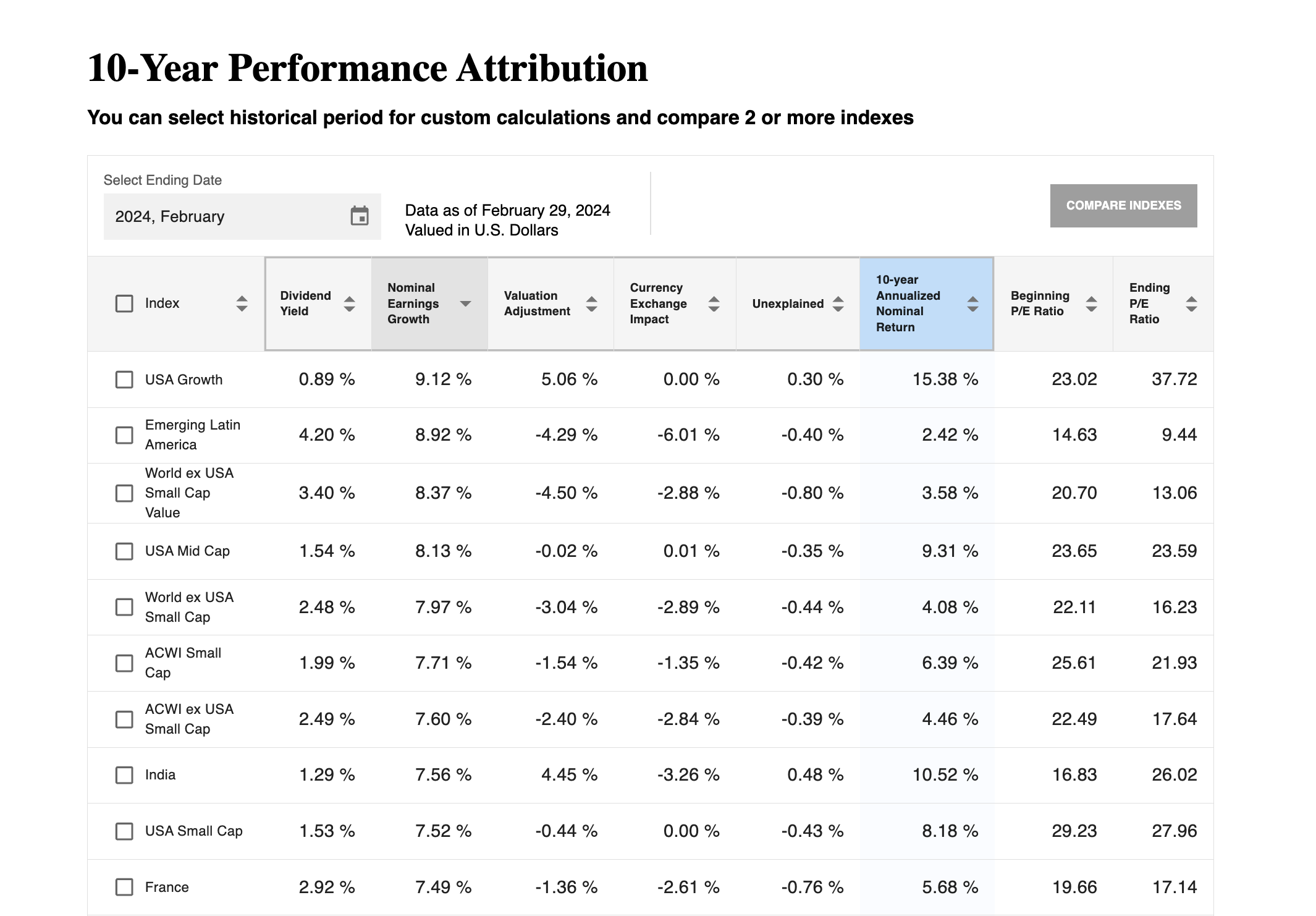

Asset Camp’s historical attribution tool breaks down the three primary drivers of stock market performance: dividend yield, earnings growth, and valuations. These, along with the calculated currency exchange impact, give you the clearest picture of what drove stock market returns and why some areas did better than others.

Demystify Over and Under Performance

Confidently grasp why ETFs performed better or worse than expectations. No more anxious assumptions, just facts.

Understand How Emotions Impact Stocks

Investor emotions are reflected in how much they are willing to pay for stocks. Confidently glimpse investor sentiment and see how changes in valuation are affecting the performance stock indexes

Know Where to Invest Next

Quickly understand the current market landscape—where there are opportunities and potential risks.

Rank and Sort Indexes by Performance Factors

Key in on which indexes performed best or worst, based on individual drivers or overall performance.

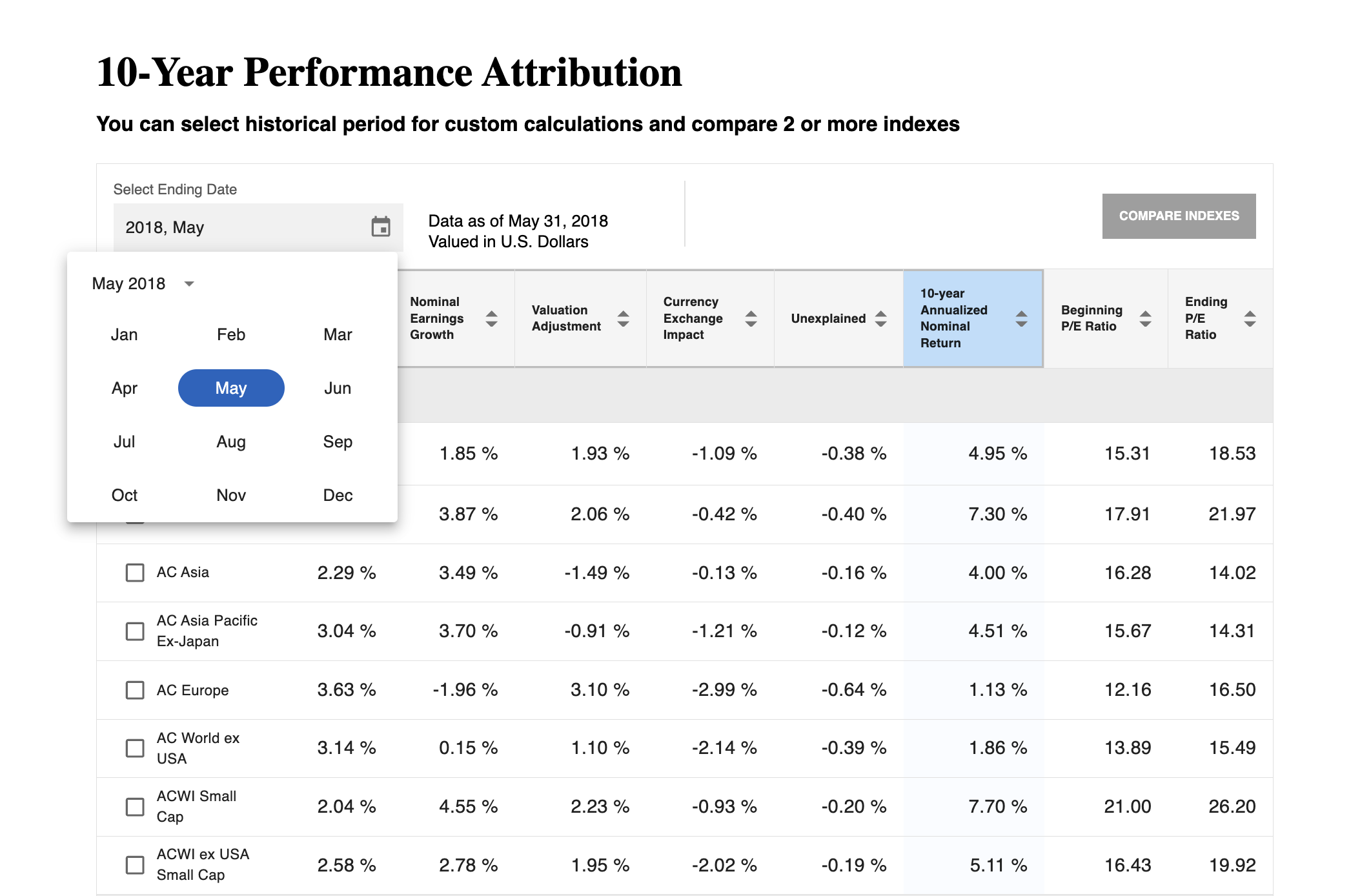

Choose Your Ten-Year Performance Periods

Ten years is an ideal performance timeline: long enough to accurately see what happened, short enough to be meaningful and digestible. And you get to pick which ten-year period to analyze.

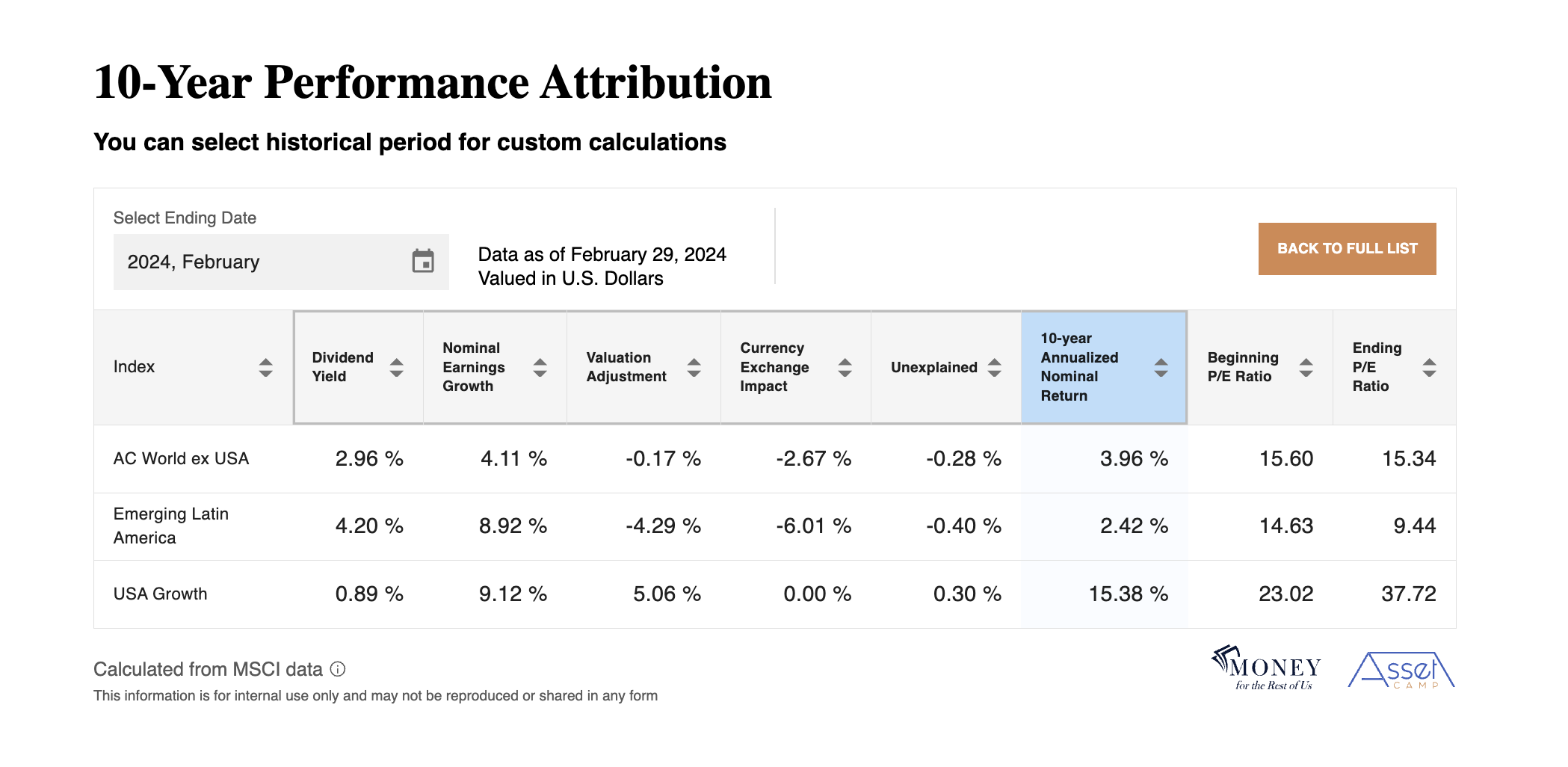

Choose and Compare Only the Indexes You Care About

Our 46-index list is robust, but you can select and focus on comparing and ranking just the indexes you are interested in.

Ready to take your next step?

Act on the same data as the professionals.